Choosing the right insurance policy can be tricky, right? I mean, there are so many options out there, and when it comes to protecting your family, you don’t want to make the wrong decision.

That’s why we’re diving deep into two of the most popular types of insurance: Life Insurance and Term Insurance. Both serve the purpose of securing your loved ones financially, but they have some key differences that can significantly impact your choice. So, which one is better for you?

Let’s break it down, step by step.

What is Life Insurance?

Life insurance is like that friend who’s always got your back, no matter what happens. It’s a policy that lasts your entire life (hence the name) and pays out a lump sum to your beneficiaries when you pass away. But that’s not all—some life insurance policies even come with a savings component, allowing you to build up cash value over time.

What is Term Insurance?

Term insurance is a bit more straightforward. It’s the “no-nonsense” type of insurance that covers you for a specific period, usually 10, 20, or 30 years. If something happens to you during that term, your beneficiaries get a payout. If not, the policy expires, and that’s the end of it—no savings, no cash value, just pure protection for a set time.

Key Differences Between Life and Term Insurance

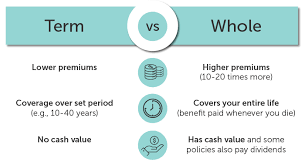

To really understand which one is better for you, we need to dig into the main differences between the two types. Life insurance and term insurance may sound similar, but they’re quite different in terms of coverage, cost, and benefits.

1. Duration of Coverage

- Life Insurance: As the name suggests, life insurance is permanent. It covers you for your entire lifetime, as long as you keep paying the premiums.

- Term Insurance: This is temporary. You’re only covered for the term length you choose, whether it’s 10, 20, or 30 years.

2. Cost

- Life Insurance: It’s no secret that life insurance is pricier. You’re paying for lifelong coverage and the added benefit of building cash value.

- Term Insurance: Term insurance is the budget-friendly option. It’s cheaper because it’s purely insurance without the bells and whistles of savings or investment components.

3. Cash Value

- Life Insurance: One of the standout features of life insurance is its ability to accumulate cash value over time. This cash can be borrowed against or even used to pay your premiums.

- Term Insurance: Term policies don’t have any cash value. It’s all about protection during the term and nothing else.

4. Flexibility

- Life Insurance: Life insurance policies are flexible in terms of investment and can be adjusted as your financial situation changes.

- Term Insurance: Term insurance is pretty rigid. Once you choose the term, you’re locked into that policy until it expires.

Who Should Consider Life Insurance?

Life insurance might be the better choice for you if you’re looking for something permanent that also acts as an investment tool. It’s perfect for people who want to leave a lasting financial legacy for their families and are comfortable paying higher premiums in exchange for lifelong coverage and the added benefit of cash value growth.

Who Should Consider Term Insurance?

If you’re more concerned with affordability and just need coverage for a set period, term insurance is your go-to option. It’s great for people with young families or those who have specific financial responsibilities (like paying off a mortgage) that will be cleared in a few decades.

When is Life Insurance a Better Option?

Let’s say you’re in your 30s, and you want to make sure your family is financially secure for life. Life insurance offers that peace of mind. Additionally, if you’re interested in building wealth through your policy, the cash value component makes life insurance an attractive choice.

When is Term Insurance the Smarter Choice?

On the flip side, if you’re in your 20s and just starting a family, term insurance can be a lifesaver (literally). It’s cheap, and it gives you the financial safety net you need while your kids are young and your debts are high. Plus, you can lock in a low premium when you’re young and healthy.

Life Insurance as an Investment

We’ve mentioned that life insurance can accumulate cash value, but what does that really mean? Think of it as a savings account that grows tax-deferred. Over time, you can borrow against it or even surrender your policy to cash out, although this can impact your death benefit.

Term Insurance for Specific Goals

Term insurance is ideal if you have a specific financial goal in mind. For instance, if you want to make sure your mortgage is covered in case something happens to you, a 30-year term policy can give you that protection until your loan is paid off.

Premium Comparison

One of the biggest differences between life insurance and term insurance is the cost of premiums. Term insurance premiums are significantly lower than life insurance premiums. However, with life insurance, part of your premium goes toward building cash value, which term insurance doesn’t offer.

Life Insurance Payouts vs. Term Insurance Payouts

Both types of insurance will provide your family with a lump sum payout if you pass away during the coverage period. But with life insurance, you’re guaranteed a payout as long as you keep the policy active. With term insurance, if you outlive the policy, your beneficiaries won’t receive anything.

Factors to Consider When Choosing Between Life and Term Insurance

Deciding between life and term insurance depends on several factors. Consider your age, financial goals, family situation, and how much you can comfortably pay in premiums.

Affordability: The Bottom Line

Let’s be honest—budget is a major factor for most of us. Term insurance is the clear winner here in terms of affordability. However, life insurance provides lifelong coverage, which can be more cost-effective in the long run if you’re seeking permanent protection.

Policy Renewal and Conversion Options

Some term insurance policies offer the option to renew at the end of the term or convert to a permanent policy. This flexibility can be helpful if your needs change over time.

Pros and Cons of Life Insurance

- Pros: Lifelong coverage, cash value accumulation, can serve as an investment.

- Cons: Expensive, complicated, may not be necessary for everyone.

Pros and Cons of Term Insurance

- Pros: Affordable, simple, perfect for short-term needs.

- Cons: No cash value, coverage ends after the term expires.

How to Make the Right Choice

Ultimately, the decision between life insurance and term insurance comes down to your personal situation. Are you looking for long-term financial security with an investment component? Or do you just need affordable protection for a specific period?

How Much Coverage Do You Need?

Before deciding between life insurance and term insurance, you’ll also want to consider how much coverage you actually need. The purpose of both policies is to financially protect your family in the event of your death, but the amount of coverage required can vary depending on your specific circumstances. Here’s a simple guide to help you determine how much coverage is enough:

- Income Replacement: How much income would your family need if you were no longer around? A general rule of thumb is to have a policy that’s worth at least 10 to 12 times your annual salary.

- Debts: Do you have any large debts like a mortgage, car loan, or student loans? You’ll want enough coverage to pay these off so your family isn’t left with financial burdens.

- Education Costs: If you have kids, think about their future education costs. How much will it take to cover their college tuition and related expenses?

- Final Expenses: Funerals aren’t cheap. You should factor in at least $10,000 to $15,000 for burial and other final expenses.

Term Insurance and Employer Coverage: Is It Enough?

Many people assume that the life insurance coverage provided by their employer is sufficient. But is it? Most employer-provided policies only offer a limited amount of coverage—typically around one to two times your annual salary. While this might sound like a lot, it’s often not enough to fully protect your family.

If you’re relying solely on your employer’s coverage, it’s important to consider whether it’s enough to cover all your family’s needs. Employer-provided life insurance policies are also often term-based, meaning they expire when you leave the company. Having your own term or life insurance policy ensures you’re covered, regardless of your job situation.

The Role of Riders in Life and Term Insurance

Riders are additional features that you can add to your life or term insurance policy to customize it to your needs. These can be a great way to enhance your policy without having to buy a whole new plan. Here are a few common types of riders:

- Accidental Death Benefit: This rider provides an extra payout if you die due to an accident.

- Waiver of Premium: With this rider, your premium payments are waived if you become disabled and unable to work.

- Critical Illness Rider: This rider allows you to access a portion of your death benefit if you’re diagnosed with a critical illness like cancer or a heart attack.

- Child Term Rider: If you want to add coverage for your children, a child term rider can offer additional protection.

Which Policy is Better for Young Families?

If you’re a young family just starting out, term insurance is often the better option. Why? Because it offers affordable coverage during the years when you need it most—when your kids are young, you have a mortgage to pay off, and other financial responsibilities are at their peak. Plus, since you’re likely younger and healthier, you can lock in a low premium for a 20- or 30-year term policy, which gives you solid coverage while your family grows.

On the flip side, if you can afford the higher premiums and are thinking about long-term financial planning, life insurance can also be a good option. The cash value that builds over time can be used for college tuition, retirement, or other major expenses. It’s like hitting two birds with one stone: you’re protecting your family and investing for the future.

Which Policy is Better for Older Individuals?

For individuals in their 50s or 60s, life insurance can be a smarter choice—especially if you’re looking to leave a financial legacy or cover estate taxes. At this stage of life, term insurance may not be the best option because the term will likely expire while you’re still alive, and renewing it at an older age can be prohibitively expensive.

However, if your main concern is covering short-term needs like outstanding debts or providing financial support for dependents, a shorter-term insurance policy might still make sense.

Estate Planning: How Life Insurance Can Help

When it comes to estate planning, life insurance plays a crucial role. It can help ensure that your loved ones aren’t left with hefty estate taxes or legal fees after you’re gone. Additionally, life insurance payouts are typically tax-free, which means your family can use the full benefit without worrying about Uncle Sam taking a cut.

If you have significant assets or plan to pass down a large inheritance, life insurance can be an effective tool for covering these costs and ensuring your estate remains intact for future generations.

Living Benefits: An Often Overlooked Feature

Did you know that life insurance can benefit you while you’re still alive? Many permanent life insurance policies come with “living benefits,” which allow you to access part of your death benefit under certain conditions, such as being diagnosed with a terminal illness. This feature can provide financial support when you need it most, without affecting the overall payout your family will receive.

Term insurance, on the other hand, typically doesn’t offer living benefits. It’s designed purely for death benefit protection, which is why it’s generally cheaper.

How to Lower Your Life Insurance Premiums

While life insurance is more expensive than term insurance, there are ways to reduce your premiums and make it more affordable. Here are a few tips:

- Shop Around: Don’t settle for the first policy you find. Get quotes from multiple insurers to compare rates and find the best deal.

- Improve Your Health: Insurance companies look at your overall health when determining premiums. If you quit smoking, lose weight, or lower your blood pressure, you could qualify for lower rates.

- Choose the Right Coverage Amount: Don’t over-insure yourself. Choose a coverage amount that’s realistic for your needs and budget.

- Pay Annually: Many insurers offer a discount if you pay your premiums annually instead of monthly.

How to Lower Your Term Insurance Premiums

The good news is, term insurance is already pretty affordable. But if you’re looking to save even more, here are a few strategies:

- Buy While You’re Young: The younger and healthier you are, the lower your premiums will be. Lock in a low rate while you’re still in your 20s or 30s.

- Opt for a Shorter Term: A shorter-term policy will have lower premiums. If you only need coverage for 10 or 20 years, go for it.

- Bundle Policies: If you have other insurance needs (like auto or home insurance), bundling your policies with the same insurer can result in discounts.

Term Insurance as a Bridge to Life Insurance

Here’s a strategy that not many people talk about: using term insurance as a bridge to life insurance. If you can’t afford life insurance right now but want the option down the line, you can start with a term policy and convert it to a life policy later on. This gives you affordable protection while you’re younger and the flexibility to upgrade to permanent coverage when you’re financially ready.

The Bottom Line on Life Insurance vs. Term Insurance

Both life insurance and term insurance offer valuable protection, but the best choice depends on your personal situation. Are you looking for long-term security and the added benefit of cash value? Or do you need affordable coverage for a specific period? Understanding the key differences between these two types of policies will help you make an informed decision that’s best for you and your family.

If you’re still on the fence, consider speaking with a financial advisor who can guide you through the process and help tailor a plan to your needs.